Frequently Asked Questions

At 911 Credit Builder, we specialize in the meticulous process of credit repair, dedicated to rectifying inaccuracies and addressing negative items on our clients' credit reports to bolster their credit worthiness.

Our approach involves a thorough examination of credit reports to identify errors, followed by strategic disputes with credit bureaus and negotiations with creditors.

By implementing unique strategies, we aim to enhance positive credit factors and ultimately raise our clients' credit scores, enabling them to qualify for loans, mortgages, and more favorable interest rates.

While individuals have the option to undertake credit repair independently on their own, our expertise and personalized guidance offer a streamlined and effective solution.

It's imperative for us to uphold the highest standards of integrity and professionalism to ensure our Clients achieve greater financial stability than ever before, as everyone gets access to enhanced financial opportunities.

Good Wishes On Your Success!

Gene and Laura Davis and

The 911 Credit Builder Team

THE CREDIT REPAIR PROCESS

From consulting and strategy development to implementation and support, our comprehensive 911 Credit Builder services can help you thrive financially!

FIX YOUR CREDIT TO ENRICH YOUR LIFE!

WHAT IS CREDIT?

Credit is when you receive money, goods or services, and you agree to pay for it in the future - usually with added interest.

Nowadays, we use credit to buy many things, from houses and cars to groceries, baby toys, jewelry and clothing.

Errors are not as uncommon as you may think. More than one-third, or 34%, of Americans found at least one error on their credit report, according to a new Consumer Reports investigation.

Consumer Reports asked volunteers to get a copy of their current credit report and to check what's being reported for errors.

The 5,858 people did check their reports between Feb 1rst and April 1rst.

These results have shown that 79% of all credit reports contain errors. This is nearly 8 out of 10 reports.

Therefore most credit reports improve immediately.

It is our job at 911 Credit Builder to "challenge" the inaccurate reporting about you.

And we are very skilled at resolving most credit problems quickly within 4 to 9 months!

HOW LONG WILL IT TAKE TO RAISE MY SCORES?

Because most people won't have an increase in credit scores by 100 points in a month. It's important to start making small changes now.

It takes time to make bad credit happen. It takes time to make good credit happen.

When you pay your bills on time, lower and eliminate your consumer debts, don't run large balances on your cards over 25% of the credit limit available and maintain a mix of both consumer and secured borrowing, you'll see an increase in your credit scores happening right away.

Most "major" increases take effect within a few months.

Don't wait, as it takes 35 -45 days to update what you do today, at the bureau level, 35 - 45 days from today.

Reporting activates every 30 days to see what you did over the last 30 days. That includes making on-time payments and establishing or changing your new and old credit lines or accounts.

The ingredients that make the FICO scores increase are important to know because they are simple. How long accounts have been open? How long "specific types" of credit accounts have been opened? Are there any late payments on any of them? What is the utilization on each revolving credit card account you use or on the ones that are currently closed? What do you have for debt to income ratio? Any collections or charge offs? How many? With balances?

As we educate you on making better financial choices, you will, through our services, see your own credit scores increase. 93% of our clients see their credit scores increase dramatically, by following our advice. The average credit score increase is 80 points within 3 1/2 to 9 months.

IS CREDIT REPAIR LEGAL?

Yes, credit repair is legal. Our credit education and document processing services will help you to use the laws and the FCRA in your favor. That law is called "The Fair Credit Reporting Act." The FCRA gives you the right to dispute any item on your credit report. When that item cannot be verified, within a reasonable time (usually 35-45 days) it must be removed.

Errors are not as uncommon as you may think. More than one-third, or 34%, of Americans found at least one error on their credit report, according to a new Consumer Reports investigation.

Consumer Reports asked volunteers to get a copy of their credit report and to check what's being reported for errors. The 5, 858 people did check their reports between Feb 1rst and April 1rst. These results have shown that 79% of all credit reports contain errors. and 25% contain such serious errors that those people could be denied credit.

This is nearly 8 out of 10 reports. Therefore most credit reports improve immediately. It is our job to "challenge" the inaccurate reporting about you. And we are very skilled at resolving most credit issues!

WHAT IS THE 100% GUARANTEE?

You are entitled to a 100% refund on all monthly payments:

- When you do not get removed or deleted more than 25% of all the negatives worked on.

- When you have had six months of our services, from the date you retain our services.

- When you have at least 4 negatives on the credit report at the time of sign-up.

- When you have not used a credit-consulting agency nor attempted to repair your own credit 2 years previous to signing up for our services.

- When you agree to send us updated reports from the three credit bureaus: Transunion, Equifax and Experian. They will send you the response letters. They are anywhere from 2 pages to 50+ pages, every 35-45 days. They will be mailing them out in the mail to you.

Make sure you send them to us within 5 days of receipt to support@911creditbuilder.com.

It is your responsibility to make us aware when updated reports have not been received.

By keeping the IdentiyIQ service you will achieve much faster results. Normally, 50% faster results happen for those who keep the service. The updates happen every 35 days, online. This service makes it easier and faster because you don't miss any responses from the bureaus regarding the deletions or changes or non-changes updated about you by them.

WHY ARE RESULTS DIFFERENT WITH US?

There are two sides to the credit score battle. Sometimes, the creditors and the credit bureaus have done absolutely everything right and we have no case against them. On average, clients are able to remove 70% of the negative or false items from a credit report, within 3 1/2 to 9 months.

WILL THE REMOVED ITEMS EVER COME BACK?

Items cannot come back, as long as the item is current or paid at the time of removal. Or when the collection is older than three years. This holds true except in very rare circumstances. Once you have started up with our services and have stopped, should you need to start up again, we will be happy to help again. Once an item has been removed previously then we will gladly re-dispute that item at no extra charge. As long as it's the exact tradeline account we originally removed or changed.

WHAT ITEMS CAN YOU HELP ME TO REMOVE AND IMPROVE?

With our assistance and document processing, our clients have had great success with “getting negative items removed from their credit reports such as” bankruptcies, foreclosures, collections, charge-offs, repossessions, medical bills, credit card debts, credit checks, inquiries, late payments, old addresses, wrong reporting of your name and address, judgments, tax liens and student loans.

WHAT CAN I EXPECT WHEN I ENROLL IN CREDIT REPAIR?

We will guide you through the process from start to finish. We also prepare and send out all your documents to the three credit bureaus and also to the reporting lenders for you.

We have a superb knowledge of credit scoring and we have in-depth experience working with creditors and credit bureaus.

It may be difficult for an individual to communicate with creditors and bureaus without an in depth understanding of the techniques and regulations in place for disputing the credit reporting.

We have spent a great deal of time, 20 plus years, learning the laws that will help you to remove negative information on your report.

This empowers you and enables us to offer you a flawless, money back guarantee system.

IS CREDIT REPAIR AND EDUCATION WORTH MY TIME AND MONEY?

Contrary to what credit bureaus want you to believe, credit repair DOES work, in most circumstances. Especially, when you are not getting new negatives for us to work on while we dispute the original information. New negatives require new work.

Credit Repair only works when you are getting the best advice from an experienced professional. There are many people or businesses out there who profess to do "credit repair." Instead, it is debt consolidation and requires late payments and things going to collections. A Bankruptcy can sometimes be better.

Anyone with a credit score below 720 can benefit long-term from the advice and information provided through credit education. However, there are limiting factors that will prevent us from helping you. Two main factors are: (1) your financial situation and/or (2) the time frame in which you need to reach your results.

It is possible to remove anything from a credit report. Things just take time. It took time to add them. It takes time to dispute them. For instance, should the creditor make mistakes or not adhere to a specific time frame, the negative item may be removed.

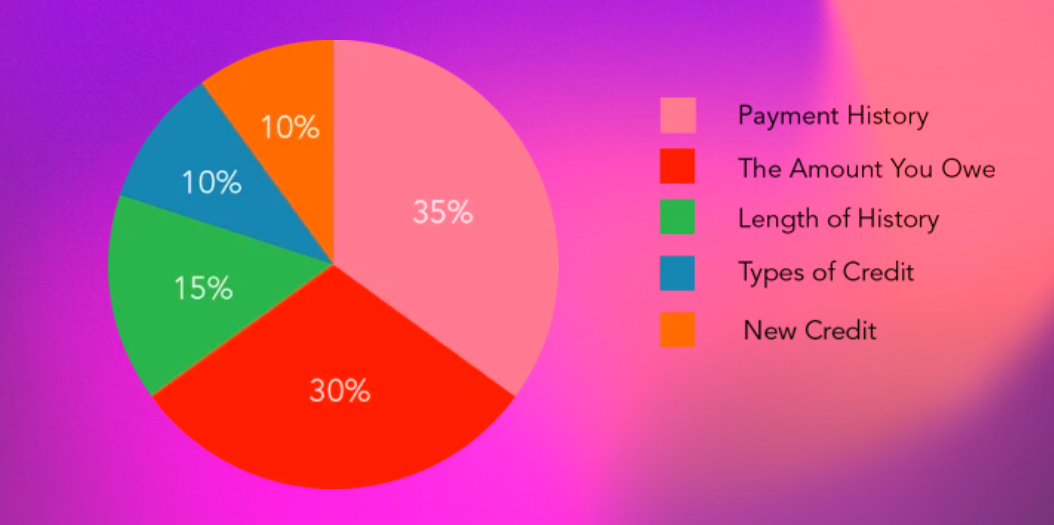

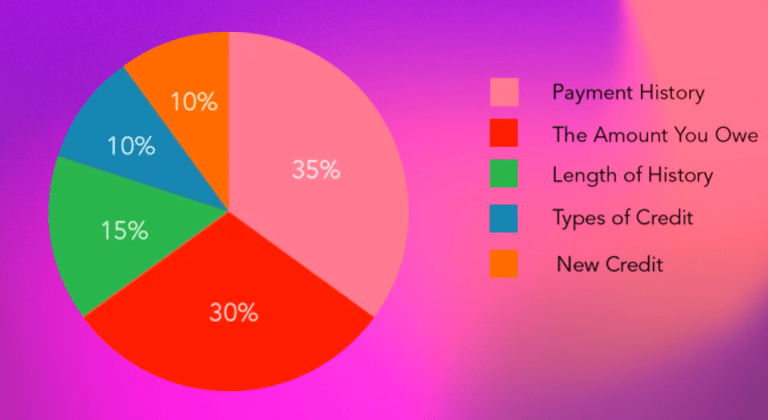

These percentages are based on the importance of the five categories for the general population.

For particular groups - for example, people who have not been using credit long - the relative importance of these categories may be different.

Those with established credit must use this score break down to determine what is needed next to build your credit and to keep your credit in a good place for a long time.

1.Personal Information

2. Credit Accounts

3. Inquiries

4. Public Records and

5. Collection Items

EASY TO FIX YOUR CREDIT FIX YOUR LIFE!

Payment History (35%)

Your track record of whether you pay bills on time or not, carries the heaviest weight of all the categories because it lets lenders know the chances of whether or not you will repay loans on time.

Amount You Owe (30%)

Debt carries the second largest amount of weight. While a small amount of debt won't completely ruin your credit score, there are ways you can show you manage it responsibly. For example, you should try to keep your credit card balances below 10% of your credit limits.

Length of History (15%)

The age of your credit, keeps track of the age of your accounts and how you have managed them during the time that they've been open.

Types of Credit (10%)

There are usually two main types of credit:

revolving credit - such as credit cards or lines of credit that revolve each month

installment accounts - auto loans, mortgages, student loans, and personal loans

While it isn't crucial to have both types of credit, it is good to show that you can properly handle multiple types of debt.

New Credit (10%)

This category tracks when your credit reports are pulled and reviewed, also called credit inquiries.

The number of inquires you have on your credit report lets lenders know how often you're shopping for credit.

It's based off of hard inquiries, which requires your consent to pull your credit report.

A hard inquiry may impact your credit scores and stay on your credit reports for about two years.

By contrast, soft credit inquiries, which can be pulled without your knowledge, don’t affect your scores the same way.

Understanding what's in your credit report can be just as important as your credit score.

Read our blog post about the differences between credit scores and credit reports.

We have made credit repair and increasing scores our habit. It’s a principle that we live by this every day.